You’re moving back to Canada from the United States?

Let’s talk about buying a home in Toronto.

Relocating back to Canada after living in the United States can be both an exciting and slightly overwhelming experience. Whether you’ve spent years in the U.S. or just a short stint, the process of moving and settling back into Canadian life does require some planning. One of the most significant steps in this process is choosing where to live & maybe even buying a home — a task that can seem daunting given the differences in markets, regulations, and lifestyles between the two countries, especially if you are starting the process from abroad.

If you’re planning to make the move and lease or purchase a property in our amazing city, read on for some quick tips to help you navigate the journey with confidence.

Plan Your Move

Considerations Before Buying a Home

Immigration and Residency Status

If you're returning to Canada, it's important to confirm your citizenship or residency status. For Canadian citizens, the process is relatively straightforward, but if you're a permanent resident or returning on a temporary basis, you’ll need to check visa or work permit requirements. If you're not already a Canadian citizen or permanent resident, you'll need to look into the immigration process.

Understand the Housing Market

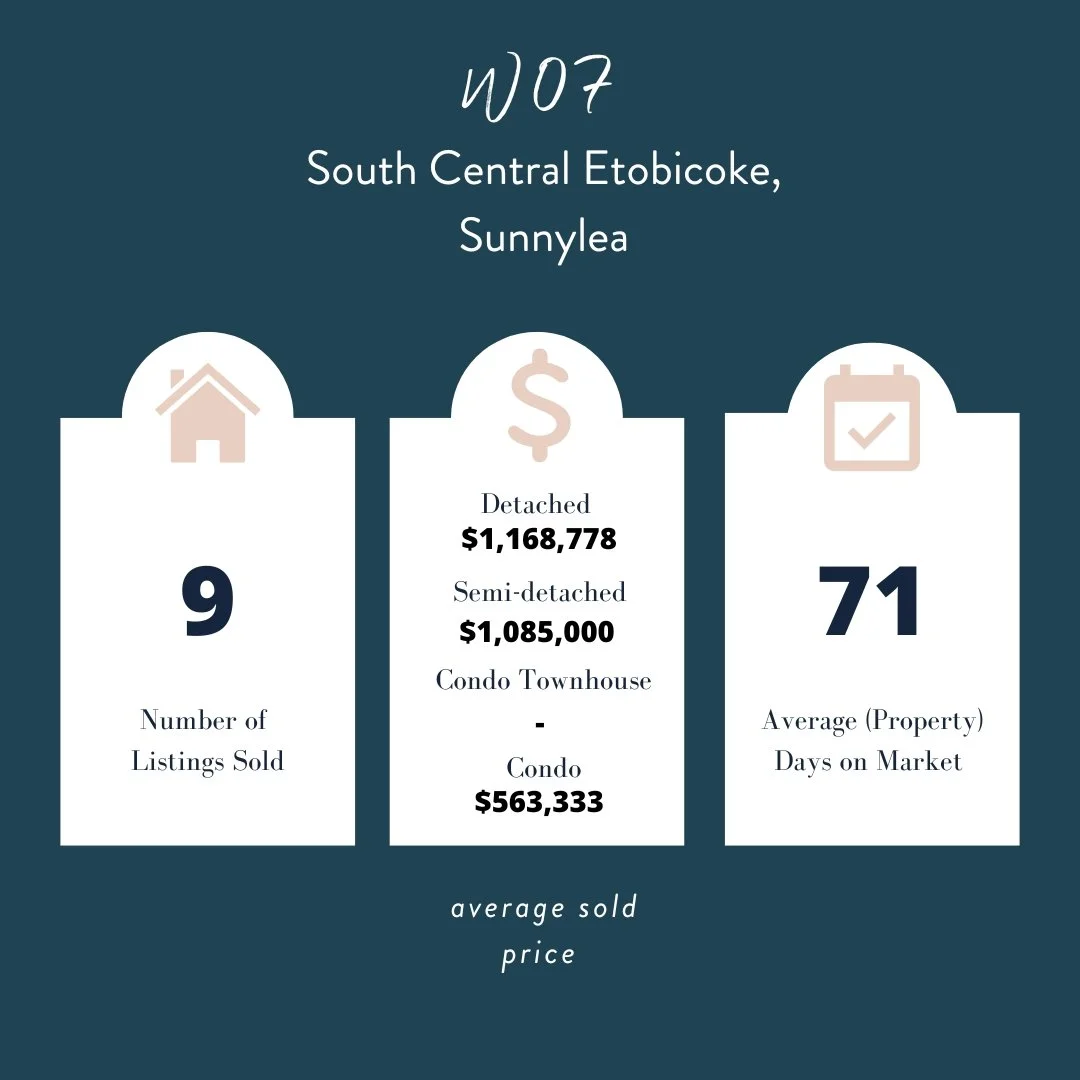

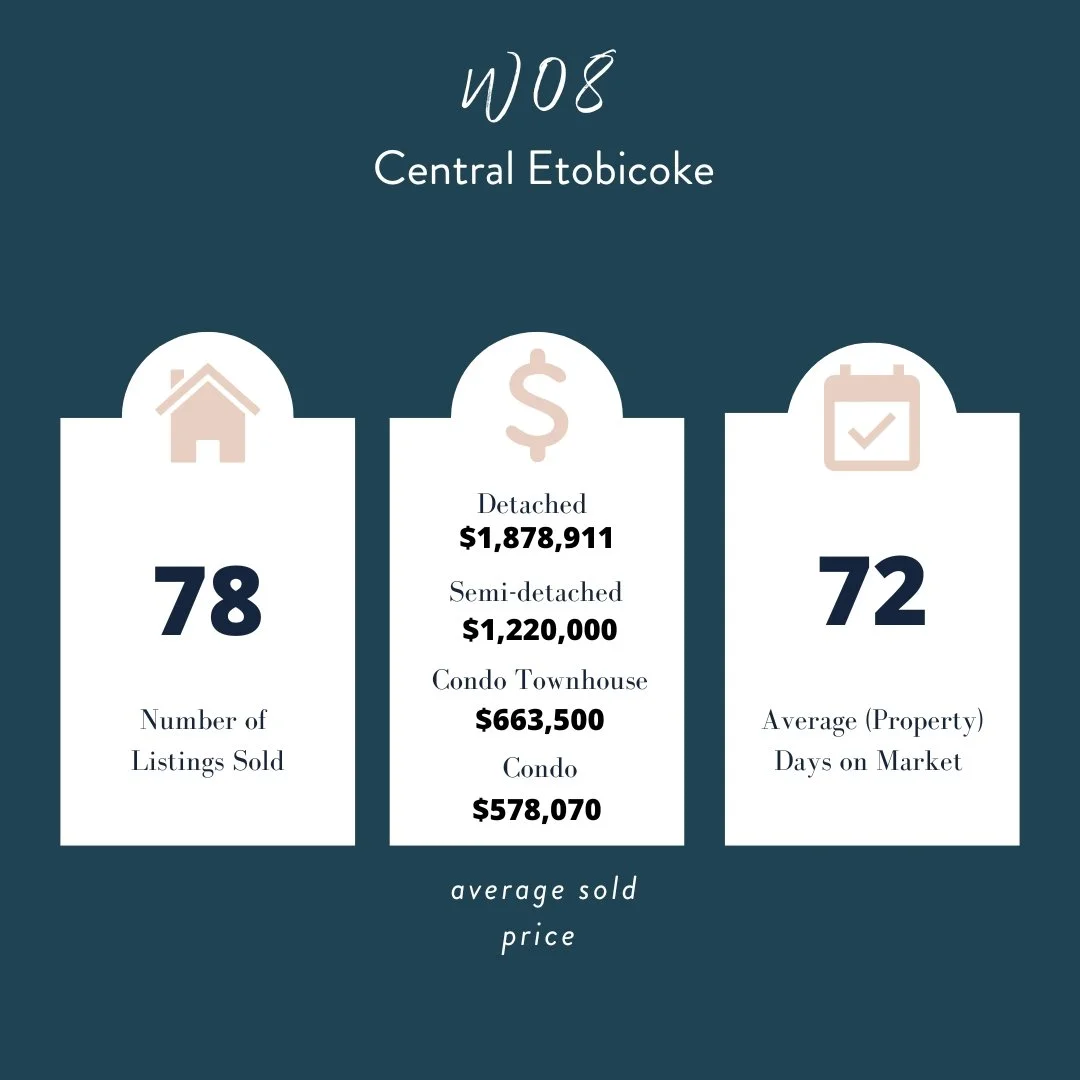

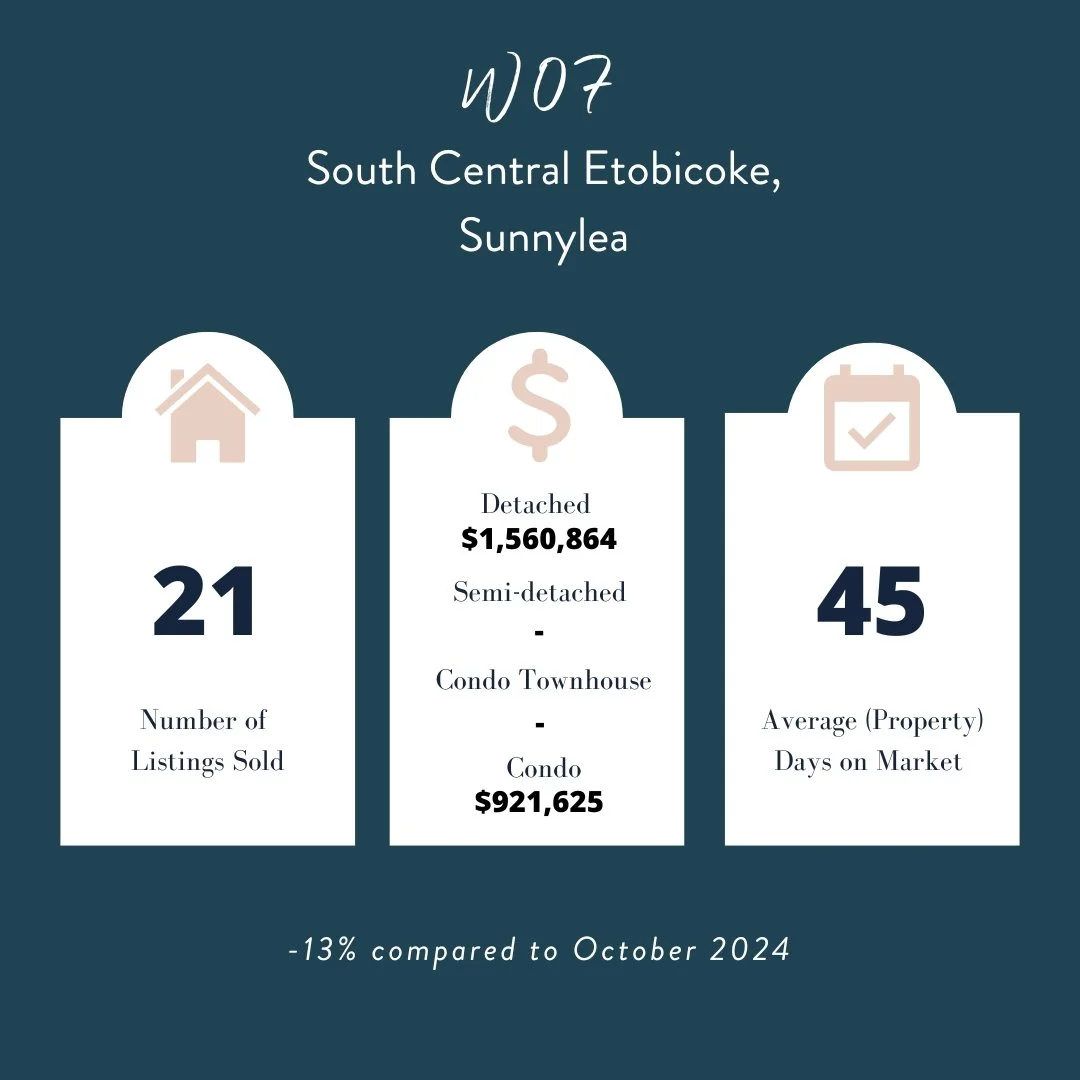

Canada’s real estate market can vary widely depending on the city and province. In cities like Toronto, the market can be extremely competitive and expensive. In smaller towns or rural areas, prices will likely be more reasonable. Do some research on the market trends in the area you’re considering. Websites like realtor.ca & HouseSigma can give you an idea of the prices, types of properties available, and the market dynamics. Check back here each month as we provide a monthly summary of the Toronto Real Estate market focusing on west end neighbourhoods, you can find the ‘numbers’ on our blog.

Set a Budget

Start by evaluating your financial situation. Consider how much you can afford to spend on a home, taking into account your savings, expected income, and the type of mortgage you can qualify for. Canadian banks and financial institutions offer tools to help you assess how much house you can afford. Keep in mind that the housing market in Toronto can be competitive, so having a clear budget will help you make decisions more efficiently.

If you’ve been living in the United States, it’s important to understand the mortgage process in Canada. We suggest you connect with a Mortgage Broker or bank that has experience in helping returning Canadians with their financing. For example, you can generally expect to pay a higher down payment than in the U.S., especially if you're a non-resident.

Pre-Approval Process

Getting pre-approved for a mortgage is essential. This process involves the bank evaluating your financial situation, including your credit history (both in the U.S. and Canada), income & employment status, debts, and assets. Having pre-approval in hand before you start house-hunting not only gives you a better idea of what you can afford but also strengthens your position when making an offer, especially in a competitive market.

Choosing the Right Neighbourhood

(Yes, neighbourhood with a ‘u’!)

Your decision on where to buy will depend largely on your work situation (commute time), family needs (schools) , and lifestyle preferences.

Toronto, Etobicoke, Mississauga, Oakville and more: There are so many great neighbourhoods in the Greater Toronto Area and we’ve highlighted a few of our favourites on our neighbourhood pages. We’ve also rounded up some information about choosing a high school and registering for kindergarten.

Work: If you’re moving back for work, make sure to factor in the location’s proximity to your job so you aren’t spending extra time commuting. One of the many reasons we love the west end is its proximity to commuter train lines, various highways and two airports.

Lifestyle Preferences: Toronto offers a high quality of life with excellent healthcare, outdoor activities, and a welcoming cultural environment. You may want to consider the local amenities, schools (if you have children), and overall community vibe. We live and work in the west end neighbourhoods of the city & are always happy to educate buyers about the differences of each pocket.

House-Hunting: What to Expect

The process of searching for a home in Canada can be similar to the U.S., but there are some differences to keep in mind.

Real Estate Agents

In Canada, it’s common to work with a real estate agent to help you find the right home. Real estate agents are typically paid through the seller's commission, meaning there is no outright cost for buyers to hire one. Your agent can help you navigate the market, vet properties for you, schedule viewings, do background checks on schools & neighbourhoods, and negotiate offers.

Home Inspections and Conditions

Before finalizing a purchase, it’s important to conduct a home inspection. Toronto real estate transactions can include a conditional period during which you can inspect the property and secure financing or in a sellers market, this conditions are met before an offer night so your offer can be competitive. Happy to explain this concept more, just reach out!

Offer and Negotiation

Once you find your dream home, you’ll need to make an offer. Depending on the market, you might face competition, so it’s essential to understand the bidding process. In Toronto, homes can sell for above the asking price due to high demand. Be prepared for some negotiation, and trust your agent to advise you on the best strategy.

The Closing Process

Once your offer is accepted, you’ll move into the closing process. This involves finalizing your mortgage, signing the necessary legal documents, and ensuring that the title of the property is transferred to you. You’ll also need to budget for closing costs, which can include legal fees, title insurance, land transfer taxes, and moving expenses.

Land Transfer Taxes

Canada has a land transfer tax that varies by province (& city!) and is based on the purchase price of the home. For instance, in Toronto you can the provincial and city land transfer tax rates, so be sure to account for these costs when planning your budget. A handy calculator can be found here.

Registering the Property

Finally, the property will need to be registered in your name with the local land registry office. This step is typically handled by a lawyer, but it’s something to keep in mind.

Moving home

After you’ve bought your new home, the fun part begins, settling in!

Moving back to Canada means adjusting to a new set of norms, from public healthcare to Canadian tax laws and cultural differences. Here are a few things to keep in mind as you transition:

Healthcare: As a Canadian citizen, you’ll have access to the country’s universal healthcare system, though you may need to apply for your provincial health card (OHIP) once you’ve moved back.

Social Services: You may be eligible for certain Canadian government benefits such as the Canada Child Benefit or the GST/HST credit, depending on your circumstances. Visit Canada.ca for all the details.

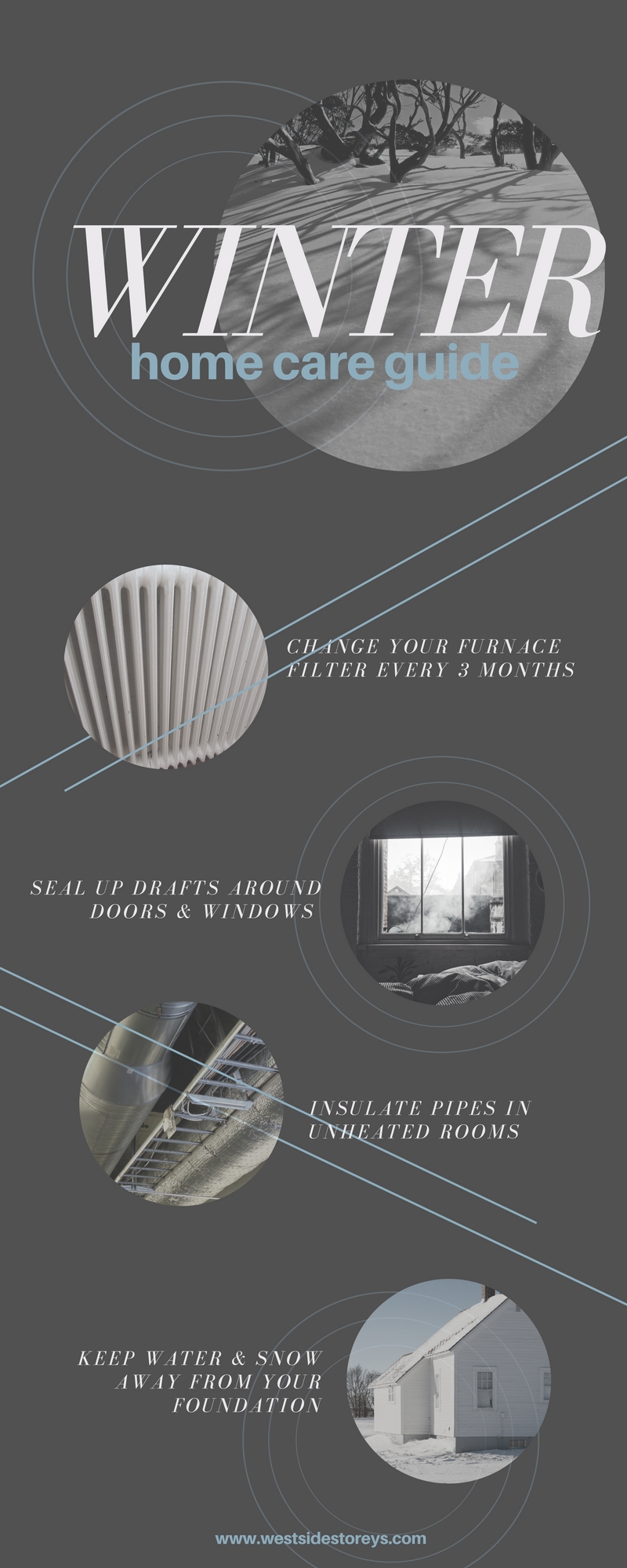

Cultural Adjustment: Even if you’re Canadian by birth, returning after a long time abroad can require some re-adjustment. From winter weather (hello snow!) to different cultural references, take the time to reacquaint yourself with your surroundings.

Moving back to Canada and buying a home is a super exciting time, but it also requires thorough planning. With careful financial preparation, an understanding of the real estate market, and the right support system in place, you can make the transition smooth and successful.

If you’d like to learn more about how we approach relocation services and could help you in your next chapter in Canada, don’t hesitate to reach out. Welcome home!